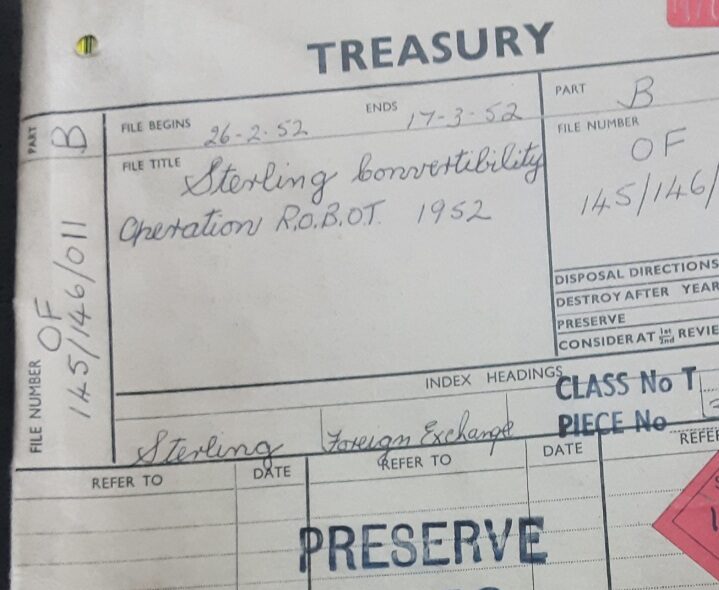

This Treasury document dates from 26th February 1952 and sheds light on the internal discussions around Operation ROBOT. Operation ROBOT was a never-enacted proposal to abandon the postwar fixed exchange rate for make sterling freely convertible.

A Brief Outline of Operation ROBOT The plan called for Britain to ‘float’ the pound rather than support it at a fixed exchange rate against the US dollar. This would entail dismantling many exchange controls and allowing the external value of sterling to be determined by market supply and demand.

Concerns Over a Sharp Devaluation Officials feared that letting sterling float could trigger a steep drop in its value, especially if international holders rushed to sell. This fall would likely raise import costs, fueling price inflation and compelling domestic expenditure cuts to realign the balance of payments.

Proposed Domestic Measures Treasury planners considered cuts to major programmes such as defence and housing to curb domestic demand. Increasing the Bank Rate (interest rate) was seen as a possible step to bolster the pound. They also discussed restricting coal for British industry in order to increase exports, though this was politically sensitive.

International Ramifications Officials worried about being blamed for sparking broader protectionism if other nations tried to insulate themselves from the knock-on effects of Britain’s currency upheaval.

Balancing Act The documents reflect a Treasury torn between a desire for long-term flexibility (via convertibility and market-driven rates) and the short-term risks to employment, prices, and the UK’s global financial reputation. A moderate devaluation could be managed with relatively less pain, but a collapse in confidence might necessitate drastic measures that would cause unemployment and stoke inflation.

These papers illuminate just how contentious the prospect of floating sterling was in 1952. Although Treasury officials acknowledged that continuing with a rigid fixed rate and heavy exchange controls was unsustainable, they were worried about how rapid ‘convertibility’ and the removal of controls could force severe domestic retrenchment and provoke international retaliation.

The National Archives (26 February 1952) Sterling Convertibility: Operation R.O.B.O.T. 1952, Treasury Papers, T 236/3241, File 145/146/011, London: The National Archives.

Following on from that, I discovered another document, dated 26th February 1952 and bearing the heading ‘Sir Edward Bridges—External Action’ offers further insight into the Treasury’s internal debate on Operation ROBOT.

Key themes include:

‘Catastrophic’ Scenario Concerns The writer (apparently Sir Edward Bridges or someone addressing him) expresses a “catastrophic” view of the balance of payments crisis if convertibility is hastily introduced. There is a fear that the economy could face a sharp rise in unemployment, extending even to key industrial exports (e.g. cars).

Commodity Prices and Global Effects The memo anticipates a fall in world commodity prices, which could partly benefit the UK by lowering some import costs but also reduce British export earnings for primary products. The mention of Australia (and possibly other sterling-area partners) highlights the complex effects on nations holding large sterling balances.

Domestic Implications The text notes it is “obviously impossible to predict” precisely how these changes would affect national income and, by extension, the Budget. Still, the official foresees the need to “reconcile ourselves to some part of the present inflationary yield of taxes being considerably reduced,” indicating that government revenue might fall if prices and employment levels fall. Emphasis is placed on the handling of industry after the Budget and how critical it will be to respond decisively to external shocks. If international markets lose faith in Britain’s capacity to manage the floating pound, the outcome could be a downward spiral of devaluation, higher import prices, and retaliatory trade barriers.

International Reactions References to the Bank of England and potential “catastrophic” fallout suggests serious concern about how overseas governments and financial markets (including the US Treasury and State Department) would respond to a sudden freeing of sterling. The worry is not merely economic but also diplomatic: Britain’s global standing and the sterling area’s stability could be severely tested by the shift in policy.

Overall, these pages reinforce the tension at the Treasury over whether to proceed with convertibility. Officials see the potential benefits of floating sterling but are acutely aware of the risks (particularly unemployment, budget shortfalls, and international push-back).

The National Archives (26 February 1952) Sterling Convertibility: Operation ROBOT 1952 – Memorandum from Sir Edward Bridges on External Action, Treasury Papers, T 236/3241, File 145/146/011, London: The National Archives.